Banks are bracing for the biggest round of job cuts since the global financial crisis as executives come under pressure to cut costs following collapsing investment banking revenues.

The layoffs – which are expected to number in the tens of thousands across the sector – reverse the massive hirings made by banks in recent years and the reluctance to lay off staff during the Covid-19 pandemic.

“The job cuts ahead are going to be super brutal,” said Lee Thacker, owner of financial services headhunting firm Silvermine Partners. “It’s a reset because they’ve been overhiring for the last two or three years.”

Banks such as Credit Suisse, Goldman Sachs, Morgan Stanley and Bank of New York Mellon have begun cutting more than 15,000 jobs in recent months, and industry watchers expect others to follow suit. , emboldened by the plans that are making headlines already announced.

“We’ve seen warning shots from the United States,” said Thomas Hallett, analyst at Keefe, Bruyette & Woods.

“Investors need to see management act on costs and try to maintain a reasonable return profile. Europeans will tend to follow US banks.

Ana Arsov, co-head of global banking at Moody’s, said she expected the job cuts to be less severe than during the financial crisis, but heavier than the collapse of markets after the crash. dotcoms in 2000.

“What we’re seeing is a catch-up in the normal banking layoffs that have been put on hiatus for the past few years,” she said. “We will see cuts in European franchises, but not as big as in US banks.”

Bank executives said Goldman’s eye-catching layoffs – part of its biggest cost-cutting campaign since the financial crisis that includes everything from corporate jets to bonuses – set a precedent that others banks would seek to follow.

“Goldman headlines accelerate decision-making,” said an industry executive with knowledge of several banks’ plans. “Now is a good time to announce painful cuts if you follow Goldman.”

The Wall Street bank began a process of laying off up to 3,200 employees last week, or 6.5% of the workforce, as pressure mounts on Chief Executive David Solomon to improve the performance of the bank on tangible equity.

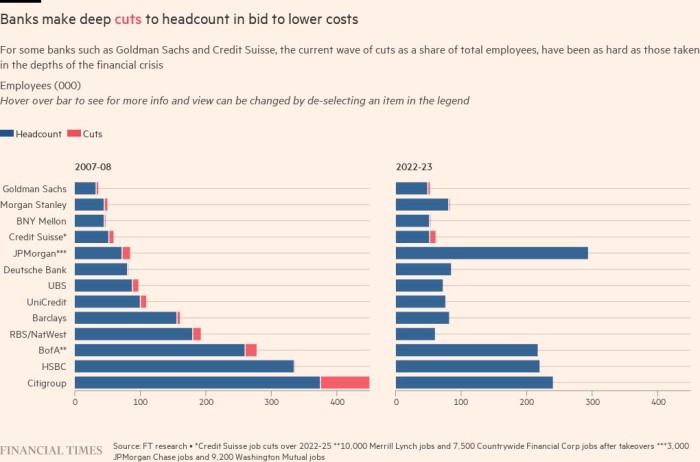

Goldman is cutting a similar number of employees as it did in 2008 during the depths of the global financial crisis, but its workforce then was two-thirds its current size.

Morgan Stanley laid off 1,800 employees in December, just over 2% of its workforce. Despite strong wealth management business, the lender’s investment bank suffered, along with fierce rival Goldman Sachs, from a nearly halving of M&A revenue last year.

Morgan Stanley said no further staff cuts were imminent.

“We were frankly a little behind,” chief executive James Gorman told analysts. “We hadn’t done anything for a few years. We’ve had a lot of growth and we’ll continue to monitor that.

Bank of New York Mellon, the world’s largest depository bank, plans to cut just under 3% of its workforce – about 1,500 employees – in the first half of the year.

Chief executive Robin Vince told the Financial Times the bank had been “very careful to recognize” that letting people go during the Covid pandemic would have “broken the social contract” with employees.

But he added that “in the normal course of business, we look at staffing levels. As a well-run business, we must be good stewards of our expense base. »

By far the biggest cuts announced so far are at Credit Suisse, which is in the midst of a sweeping strategic overhaul aimed at solidifying the scandal-ridden Swiss bank. Last October, the bank announced that it would cut 9,000 positions from its 52,000 employees over the next three weeks.

While 2,700 of the job cuts were expected last year, the bank has already started redundancy consultations for more than 10% of investment banking positions in Europe, the Financial Times reported last week.

The scale of Credit Suisse’s restructuring is greater than the bank experienced during the financial crisis, when it was forced to lay off more than 7,000 staff in 2008 but avoided a state bailout.

Not all banks expect to make major staff cuts, although they are taking other steps to cut costs.

Bank of America, which employs 216,000 people globally, said it had ‘no plans for mass layoffs’, although it was taking a disciplined approach to costs and would only hire for the most crucial positions .

Chief executive Brian Moynihan told Bloomberg in Davos that fewer people left the bank than expected last year, affecting its hiring policy.

“We exceeded hiring expectations and exceeded our headcount target,” he said. “And now we can do a hiring slowdown.”

Citigroup has so far given few details on how many of its 240,000 employees worldwide will be affected by the layoffs, but chief financial officer Mark Mason told reporters there was pressure to cut costs at the within its investment bank, following the 22% drop in the division. in profits.

“As part of [business as usual]we are constantly looking for talent to make sure we have the right people in the right roles and, if necessary, to restructure, we do that as well,” he said.

Yet at least one global bank is looking to bolster its ranks, albeit in a targeted way. UBS chief executive Ralph Hamers told Davos the Swiss lender was “bucking the trend” in hiring.

Unlike its rivals, UBS hasn’t been hiring aggressively in recent years and so isn’t under the same pressure to cut positions.

It has also devoted more resources to wealth management over the past decade and the bank’s senior executives believe the time is right to invest more in investment banking – as well as hiring in the wealth and asset management – as competitors retreat.

Those efforts include picking off disgruntled dealmakers from advisory firms, senior UBS officials told the FT.

By comparison, UBS was forced to cut 10% of its workforce in 2008 – with most positions taken by its investment bank – as the lender was bailed out by the Swiss government after suffering heavy mortgage losses. at risk.

Several of the biggest job cuts in 2008 came from banks that rescued rivals brought to their knees by the financial crisis. When Bank of America took over Merrill Lynch, for example, it laid off 10,000 employees, while laying off 7,500 workers at mortgage lender Countrywide Financial.

JPMorgan laid off 9,200 Washington Mutual employees when it took over the largest savings and loan association in the United States, in addition to cutting a tenth of its own workforce.

Meanwhile, the collapse of Lehman Brothers and Bear Stearns has driven tens of thousands of bankers out of work. In total, more than 150,000 bankers lost their jobs during the financial crisis.

And just like 15 years ago, the prospect of finding a job quickly for those who are now unemployed is bleak, according to recruiters.

“You have this horrible flood of quality coming to market, but who is picking it up?” Thacker said. “The buyside is not there to hire these people this time. They just don’t have the capacity.

news.google.com