Bitcoin Rules – But not yet… Vitalij Sova/iStock via Getty Images

Not follow your heart on bitcoin

I have recently seen a number of bullish predictions for Bitcoin (BTC-USD). As my heart pulls in this direction, my rational self – too as my reading of tea leaves – eeehhh I mean technical charts – tells me that’s just not the case.

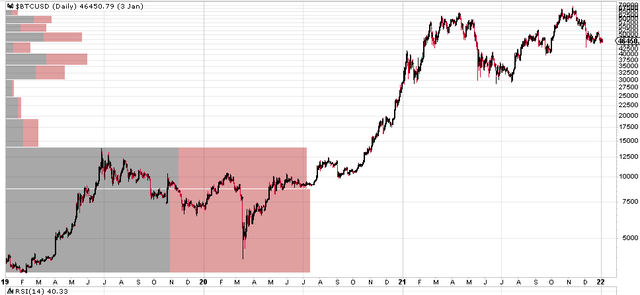

First a bit of recent history. Amid the Covid discouragement, Bitcoin reversed a previous rally and plunged to a low of $3,948 in March 2020.

Bitcoin Covid Low (stockcharts.com)

But Covid has pushed the Federal Reserve to go all out and engage in massive money printing to revive a failing economy. Bitcoin then hit all-time highs of $68,978, a 1600% gain in just 2 years, peaking in November 2021.

Since then Bitcoin has returned $53,498 dollars (78% measured from the peak), dropping to $15,480 at the end of November 2022. Talk about a roller coaster!

Speculation is high on both sides of the debate. Is the final bottom in place? Is Bitcoin Doomed? Will cryptos go extinct in a digitally enhanced version of Dutch Tulip Mania?

Let’s use a little technical analysis to find out.

Why consult the graphs?

Technical analysis is either voodoo or the best thing since my mom’s peanut butter and jelly sandwich. Or maybe a mixture of both. Over the past 15 years of trading, I have gone from complete skeptic to curious amateur to ardent follower.

Bottom line, I believe an investor ignores technical charts at their peril. For all their sleight of hand and line drawing complexity, technical graphics reflect the psychology of crowd behavior. Crowd behavior is the number one factor affecting prices in the short to medium term. The very long-term reality of profit and loss, service and product quality all interfere and shape stock prices. But it can take a loooonnnnng time.

Here is my crystal ball

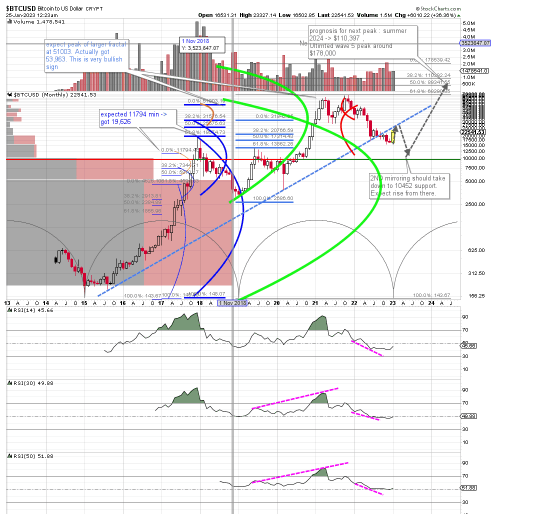

Take a look at this chart, which shows a long-term Bitcoin chart using weekly candles spanning from 2015 to the present.

Bitcoin Technical Analysis and Prediction Jan 2023 (stockcharts.com)

Sorry for all the curvy lines and color confusion. I’m going to ask you to focus on the green ellipses first. These represent the waves from Elliot Wave Analysis. Using Fibonacci calculations of the smaller fractal waves within this larger green wave, I expected Bitcoin to peak at $51,003. Instead, Bitcoin peaked at $53,963.

When this breakout occurs I have noticed that it is usually quite bullish for the long term prognosis of the underlying stock. Let us call this point 1 for the Bull case.

But first, you should expect a retracement of at least 38.2%. Well, we’ve already had more than that. In fact, we saw a decline of over 62% (to $25,552) in the entire upside since the lows of 2015.

Wait, but that’s a point for the bearish case, more often than not a drop of more than 62% is a sign that the stock wants to get back to 100%. That would mean a drop down to $155!

If this happens to Bitcoin, IMHO, fork it. It’s dead. But I don’t think that’s what the charts say.

RSI to the rescue

Look at the 30 and 50 period RSI slopes plotted on the highs that correspond to the price highs. These are drawn with pink lines. The highs trace points upwards convergently with the price highs. These tell me that this Bitcoin retracement will be severe, but will not eclipse the initial rise.

But also look at the slope of the depressions in pink. They are always pointing down. This usually means that the trend reversal from low to high is not over yet. More pain is to follow over the next few weeks.

When Bitcoin is truly ready to bottom, we will likely see the slopes of the lows being positively slanted.

Where do I expect this to happen? Well, just around the $10,400 level, more or less. This represents a 168% Fibonacci projection down from the previous wave (red) plotted from October 2021 to January 2022. This mirror effect occurs about 80% of the time. It’s a minimum, not a maximum.

Nothing prevents the mirror wave from traveling lower, technically speaking. So why $10,400? Because that’s where there’s a lot of support formed at multiple pivot points over multiple years, backed by high levels of buying and selling volume.

What’s the bottom line?

Have you already lost? Sorry for the complexity. Let me simplify. Uncover the drawn gray arrows. This is what I see Bitcoin doing. Retest the ceiling at around $34,000, moving from there to $10,400, then beyond and upwards to reach new highs around $110,000 by summer 2024.

As mentioned in other articles, the biggest area of uncertainty in my technical analysis is the time factor. I used time cycles shown in the gray arcs at the bottom of the graph. These place the peak around mid-2024. But frankly, I’m not nearly as confident about this time projection. So please don’t bet on it by adjusting your option bets at this exact moment.

Can I be wrong?

Short answer: of course not! Offhandedness aside, this has been known to happen… So I invite the reader to review a contrary point of view on these SA pages, which I find very well written: Bitcoin: a major recovery expected (technical analysis).

So where do I differ from Mr. Grummes’ analysis? I share his long-term view that the dollar is threatened by geopolitical events. I also believe that the international monetary order is in the midst of a decade of meltdown and reset, which will ultimately benefit Bitcoin.

I also agree with his statement that Bitcoin is likely to retrace at least 38%

Even if Bitcoin would take it a bit easier in 2023, a recovery towards the 38.2% retracement at around USD 35,000 would be easily conceivable.

But this is where our analysis diverges. I think the volume of buyers at $34,000 just waiting to be replenished is very large. (Just think of all the spouses hiding their brokerage statements from their better halves.) These create heavy selling pressure.

The final shoe did not drop

A retracement like 2019 of 62% is certainly possible. But unlikely in my opinion. First, 62% of retracements are statistically much less frequent. Second, a trace of the RSI price levels at their corresponding prices suggests the $35,000 level. This could evolve later to point higher, but at the moment it is not. Third, large market reversals usually form slowly over several months so that Mr. Market can exert maximum pain on impatient or inexperienced investors. It hasn’t happened yet.

Real-world events are taking shape quickly and are likely to send more pain to the crypto markets. The past 2 weeks have seen a lot of action surrounding the impending or possible bankruptcies of Gemini, Genesis and possibly even Digital Capital Group.

These factors driving these developments are very complex and extremely intertwined, but there is no doubt that they could have major implications for the crypto space.

Second, the US Congress, the Securities Exchange Commission, and the Commodities Future Trading Commission are all vying to wield their influence in the crypto markets and flex their political muscles. Until this finally crystalizes into a clearer regulatory approach, you can expect this to weigh heavily on market uncertainty.

So buy, sell or hold?

If you are a bitcoin die-hard, you might want to get started at these prices. What is a worst-case 50% drop in light of a possible and likely 500% gain in a few years?

But for most investors, I would suggest a different approach. If you like Bitcoin (and I do), invest a small amount (maybe 10% of your ultimate stake) so you don’t suffer too much from FOMO if I’m wrong. Consider taking profits of around $35,000.

If prices drop to the $10,000 level, enter with 50% of your stake. Make sure that whatever you invest you are comfortable with high volatility. Would you sell if Bitcoin fell to $3,000? So don’t invest. It is not impossible.

For most investors, I think an average dollar cost approach, spread over a period of about 2 years, makes the most sense.

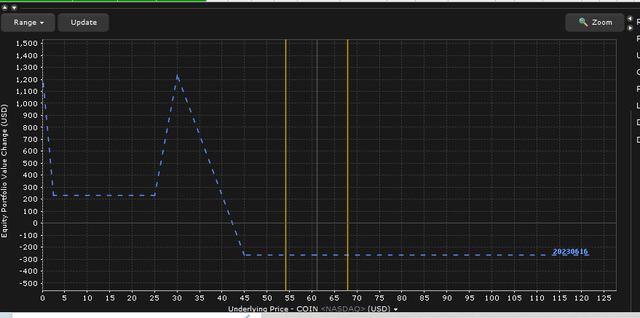

Me? I will use options. I use broken wing butterfly trades to bet down and give me about 4 months for that to happen.

bearish options trading on COIN (Interactive Broker Options)

As you can see in the chart above, a position of $267 could yield a maximum return of around $900 to $1,200. These reflect my current positions. If I am wrong and COIN does not go down or takes longer to do so (by June 16, 2023 at the latest), I will lose the entire premium paid, i.e. $267. This chart reflects the price of positions taken at the expiration date in June. If COIN were to drop precipitously to the $30 price level, my gains would not immediately be so large. This trade benefits from the passage of time and is largely unaffected by options volatility .

Strategies such as calendar trades or broken-wing butterfly trades offer very attractive risk-reward relationships, where you only lose a fraction of what you win if you get it wrong, but multiply your investment if you are right.

The biggest risk in strategies is in the execution. You should enter trades using limit orders and in the correct order to avoid unintended margin risks. Please consult a professional if you do not have experience in this area.

news.google.com