lucky-photographer

main thesis and Bottom

The purpose of this article is to evaluate the Invesco KBW Bank ETF (NASDAQ: KBWB) as an investment option at its current market price. This is a sector-specific fund, with a focus on bank stocks exclusively. Importantly, he is heavily skewed towards the biggest banking names, and is administered by Invesco.

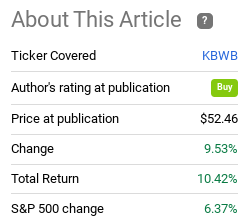

This is a fund that I own and have recommended over time for direct exposure to the US banking sector. A little over three months ago, I reiterated a “buy” rating on this ETF and have seen it perform well since that article:

fund performance (Looking for alpha)

Obviously, this is a big move for KBWB since 2022 ended and 2023 began. While I see merit in holding at these levels, these short-term gains usually make me cautious. In the case of KBWB, this sounds TRUE. I do see some macro-headwinds that suggest taking some profit and/or being more selective with positioning is the right move going forward. As such, I’m downgrading my rating to “hold”, and I’ll explain why below.

I still see merit for investment in the sector

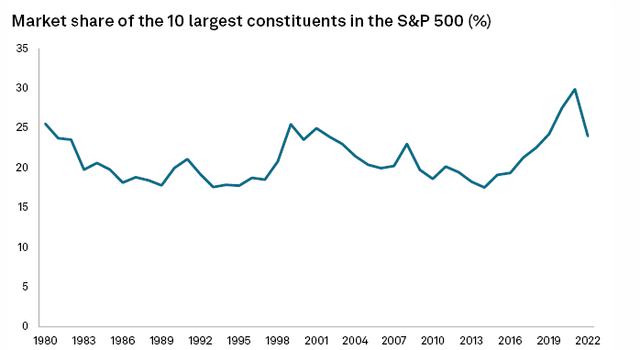

To begin the review, I want to offer an idea of why I believe that sector investment continues to be relevant. As my followers know, I’m a big believer in using sector ETFs to diversify (rather than individual stocks and/or just investing in the S&P 500). This includes KBWB and the banking sector, but also areas such as Energy, Utilities, Materials and Real Estate. A big reason I prefer this tactical approach is that the S&P 500 is heavily dominated not only by the tech sector, but also by a handful of popular names.

Now, it’s worth noting that we’ve been seeing headlines about how the S&P 500 has become less concentrated in the last year. This is true and was driven by the poor performance of the tech sector and “FAANG” stocks. But I think a little clarity is needed. While the dominance of major holdings in the S&P 500 has eased somewhat, their share of that index remains very high and above historical norms. This is illustrated in the following graph:

S&P 500 is still heavy (S&P Global)

The message I’m getting across is that diversification is still just as important today as it was when it started last year. Sure, the top holdings have gained slightly less on the S&P 500 than they did a year ago. But they still make up a large percentage, in absolute and historical terms. This tells me that he remains disciplined and that buying sectors that are underweight the S&P 500 Index still makes sense. So I see an investment case for KBWB, as well as any number of sector-themed US market ETFs one might consider.

Banks are bracing for tougher times

Now let’s talk about some headwinds. I mentioned that KBWB has performed well and that I like it as a way to diversify away from the tech-heavy S&P 500 Index. These sound like great arguments, so why a downgrade to “hold” for this fund?

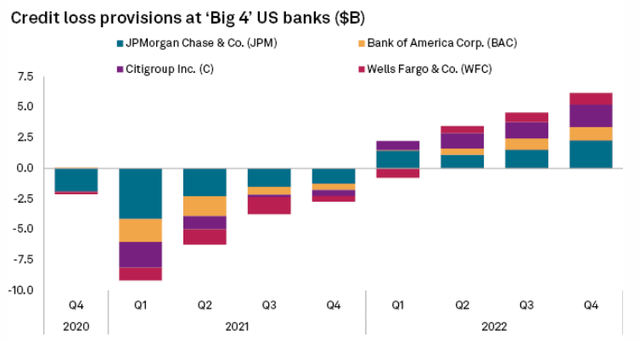

The answer is due in part to what the big banks are doing. Specifically, they are preparing for more volatile times ahead in the credit markets. I know this because if we look at their loan loss provisions, which are the money lenders set aside for loans that go “bad” (not paid back), we see that the largest banks in the US are aggressively inflating those reserves:

Provisions for credit losses (top 4 US banks) (Set of facts)

This is in stark contrast to how these companies were responding to the macroeconomic environment in 2021. As the economy improved and credit conditions turned out to be stronger than previously feared, banks began releasing loan loss provisions. Today, they are returning the money. in that category.

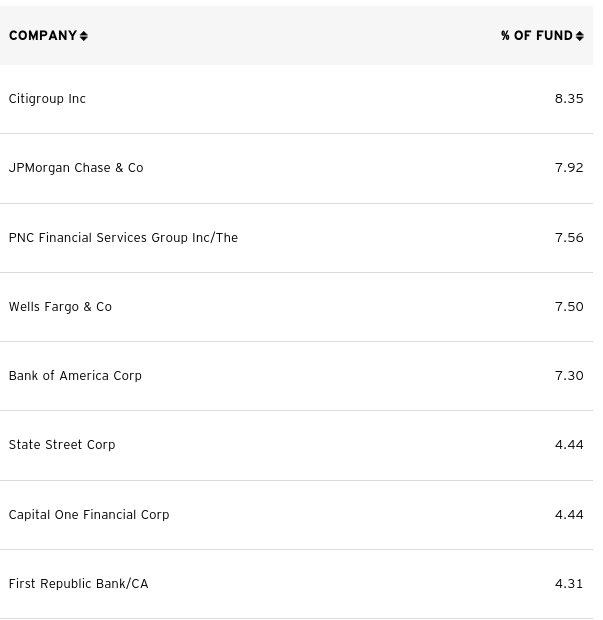

While that graph only shows four companies, we have to keep in mind that these are some of the largest banks in the world. Beyond that, they represent almost a third of the fund’s total assets in KBWB. So it is very relevant for investors in this fund:

Main fund holdings (Invesco)

This is a case of “following the smart money.” I see the largest financial institutions taking steps to prepare for a recession and tightening lending standards. They expect a worsening of the credit environment, and if that materializes, it almost certainly means that we will see some pressure on corporate earnings. That often leads to a bumpier ride in the stock market, so switching to a more neutral outlook on KBWB seems well supported at this point.

Higher rates are better, right? Something like

The next topic I will discuss has to do with interest rates. Generally speaking, banks and lenders make more profit when rates are higher. But this backdrop comes with caveats. One, it depends on economic conditions. High rates with a worsening economy could mean fewer loans and/or fewer loans repaid. That is not advantageous. Conversely, a lower rate environment in a strong economy could mean less absolute interest per loan, but more loan origination and a high percentage of on-time payments. The net result is that when it comes to large banks and determining whether an interest rate environment is favorable, the answer is often “it depends.”

It is with this understanding that makes the current situation difficult. The Federal Reserve (and other global central banks) have been aggressively raising interest rates. The mantra “higher rates are better for banks” could exist here. The problem is that I’m not sure it does. One reason discussed above: Banks are setting aside more cash for bad loans. This means they expect more loans to go sour, and that will likely reduce future short-term borrowing as well.

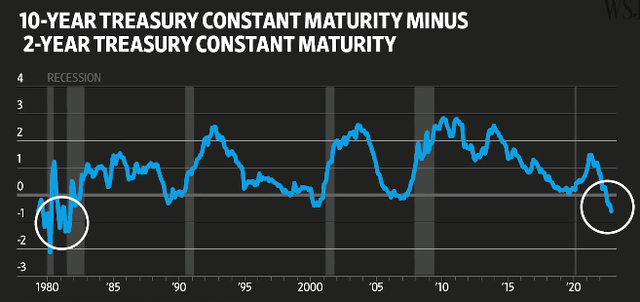

The other problem I see is the performance curve. It has been investing on and off for a while since the Covid pandemic began as investors grappled with the outlook for the economy. So while the inversion of the curve right now is not new, the level of inversion is concerning. It has reached a level now seen since 1981:

Yield curve (extreme investment) (Wall Street Journal)

The concern is twofold. The first is what this means for the economic outlook. Yield curve inversions often signal recessions, and this sharp inversion is a frightening omen. This will put pressure on corporate America as a whole (if it comes to fruition), including KBWB by extension.

The second problem is that the inversion of the yield curve exposes a disconnect in the interest rate market. What I mean is that it disrupts the natural order of longer-term debt that charges more interest. The logic is simple. The longer the time horizon for a loan/credit product, the higher the interest it should earn. After all, investors want to get paid more for taking on more risk in terms of a longer time horizon. But the inverted curve turns it around. Short-term debt ends up with higher rates, which means that investors are not paid adequately for offering credit for longer periods of time. While this does not make logical sense, it reflects the outlook for the future, which is negative.

This can be especially painful for banks because their bread and butter is to offer a fixed interest rate for short-term deposits and then lend those deposits at a higher interest rate for long-term loans. An inverted curve makes this more difficult and leaves the lender with limited opportunities for this “catchback” performance. As a result, future net interest margins are likely to be in question for banks in general. With this in mind, it should be clear why I am in favor of downgrading as KBWB in the future.

Bottom line

KBWB has been a real winner lately. As such, it probably makes sense to stick with it. If the Fed cools down on its aggressive language, the economy avoids a deep recession, and credit losses come in below expectations, this is a fund that could continue its recovery.

But there are headwinds in this case. The yield curve will put pressure on the bank’s margins, this recession indicator is often accurate, and loan loss provisions will eat into net earnings if they are needed. This back-and-forth context tells me that now is a good time to either take some profit or be more selective with new positions. A 10% pop in a little over three months is a huge gain, and I’m not going to chase returns here. Rather, I’ll make a profit, be patient, and hope to add at cheaper prices. Therefore, I believe a ‘hold’ rating is appropriate and I suggest readers approach the bottom cautiously at this point.

news.google.com