jetcityimage

Bear Thesis

If one is looking to invest money in the stock market in a high risk, interest free environment, I believe it has to be on the highest quality companies. It does not matter if the company screams itself as growth or value. And if it’s about growth, it shouldn’t be growth disguised under unprofitable business models, questionable practices, or massive piles of debt. When I watch Planet Fitness (NYSE: PLNT), the red flags I see tell me that their growth is not as attractive as it looks and in my analysis I will explain why this would not be a good investment for an investor.

Quick summary

Planet Fitness is a popular discount gym franchise in the United States. The gym has become popular for its low prices and “judgment-free zone” philosophy. Depending on the level of membership, they also offer some differentiation in their product offerings. The company relies heavily on franchising for its expansion and had nearly 2,300 stores spread across different parts of the world including Canada, Mexico and Australia.

Growth at a cost

The company has recorded impressive growth figures year after year. Since 2017, it has grown its number of stores at a compound annual growth rate of 10%. Its membership levels have also grown at a similar rate and currently boast over 15 million members. Until COVID, it had posted more than 50 consecutive quarters of system-wide same-store sales growth. The company also demonstrates profitability. So where are the cracks in this growth story?

Planet Fitness is on a treadmill of poor growth and it is very evident when you see how its growth is funded. In search of expansion and growth, the company took on more and more debt.

Why is there a downside to growing a business through excessive debt? This can be a risky business, as it increases a company’s financial leverage and makes it more vulnerable to economic downturns and other negative events. Gym spending is discretionary spending and may be one of the first expenses to be cut during an economic downturn. When more of the company’s assets are financed with borrowed money, the company must continue to pay interest and principal on its debt, regardless of its financial performance. At some point the company will reach the end of its line with its use of debt and when this happens it can restrict the company’s ability to make investments or take advantage of new opportunities since a significant portion of its cash flow must be devoted to repaying its debt. In the worst case, where its profits are not enough to cover its interest payments, the company may be forced to default on its debt and possibly face bankruptcy.

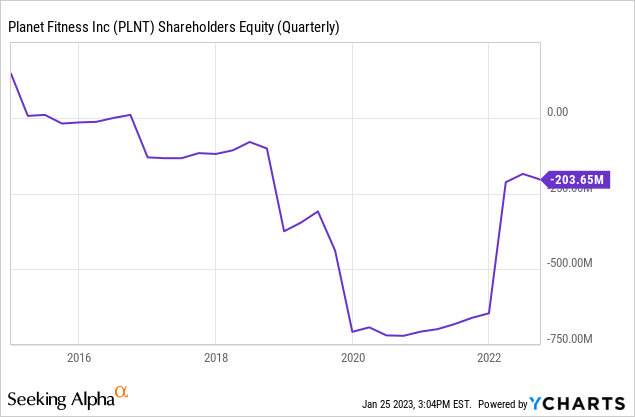

Negative equity

In other words, it means that the company owes more than it has. As of the date of their last report, their total liabilities stood at $3 billion, with long-term debt alone approaching $2 billion. When this is compared to their total assets of $2.8 billion, this gives us negative shareholder equity. My theory is that they started laying the groundwork for their aggressive expansion from 2016 and from there it’s pretty obvious how they chose to get there. The problem escalated in 2019 and it looks like the situation only slightly improved in 2022.

How well is their debt covered by their cash flow?

For a company focused on growth, it’s good news that Planet Fitness not only has a positive bottom line, but also positive operating cash flow. In situations where equity is negative, cash flow can be decisive for the business. But we need to see how well their OCF covers their high debt. At close to 10%, this indicates that the company is in a vulnerable position and any decrease in its cash flow would make the situation very difficult.

In addition, we can even examine how well the company is able to manage the interest payments on its debt (interest coverage ratio). At less than 2.5, it is often considered a red flag and signals solvency problems to the company, even with a minor impact on its profits.

Altman’s Z-score

This is another way of looking at a company’s chances of solvency. The score is calculated using a combination of profitability, leverage and revenue. Data from Y-Charts shows the score to be 1.2. A score below 1.8 means trouble for a business.

Questionable practices

Some Planet Fitness practices are unique to the company and can best be described as slippery. The company is known for its in-person or mail-only cancellation policies. I was a member of Planet Fitness almost 6 years ago and due to unforeseen circumstances I had to leave the country but was unable to have my membership canceled remotely (as I had left the country, I finally had to close all my bank accounts which took care of this problem). In all honesty, if I had gone through the membership agreement with a fine-toothed comb, I could have prevented this scenario. However, most companies adapt to exceptional circumstances, but not Planet Fitness. I had almost forgotten about this incident and remembered it recently when I was informed of a recent short report published by The Bear Cave. In the brief report, mention is made of hundreds of incidents where customers have tried to cancel their membership, but without success. From the article:

Through numerous Freedom of Information Act requests, The Bear Cave has uncovered hundreds of consumer complaints about overcharging, fraudulent transactions, excessive fees, and non-cancellable memberships. The complaints allege a pattern of misconduct including 1) customers sending multiple cancellation letters which are ignored, 2) in-person cancellation attempts which are ignored 3) billing resumes after cancellation 4) fictitious charges and 5) Planet Fitness prevents customers from canceling because they owe a balance back, among many other complaints.

In theory, this practice can generate more revenue and customer loyalty. When the cost of membership is low but the hassle of canceling is so painful, people may not want to deal with it unless it really affects them. If left unchecked, this can cause consumers to develop a negative perception of the company, which could lead to lower new member acquisitions and loss of business from dissatisfied customers.

Another practice that I personally found really fun was their free pizza days. This seems like a counter-intuitive approach to promoting healthy habits, since giving pizza after a workout seems to contradict the idea of maintaining a healthy diet. It’s like visiting a doctor and getting a free pack of cigarettes or going to the dentist for cavity treatment and being offered free donuts. It’s a nice gesture, but it seems to undermine the overall goal of promoting healthy habits.

Inflated valuation and downside risks

Planet Fitness trades at 95 times earnings, eight times sales and 30 times cash flow. All of this suggests that its valuation is extremely high and would make its current price unsustainable. Because its liabilities are greater than its assets, its book value (P/B ratio) is non-existent. For its forward multiples to become reasonable, its earnings and sales must grow organically above the industry average. Any additional spending on S&M would reduce its margins, which would again affect its profits. Nor does it seem reasonable for the company to turn to debt. To strengthen its balance sheet, it could consider a share offering but that would dilute existing shareholders. There doesn’t seem to be an easy way out of here.

| Price/Benefit | Avg. | Implicit disadvantage | Price/Sales | Avg. | Implicit disadvantage |

| 95.19 | 6:42 p.m. | >50% | 8.7 | 1.45 | >50% |

Source: Author

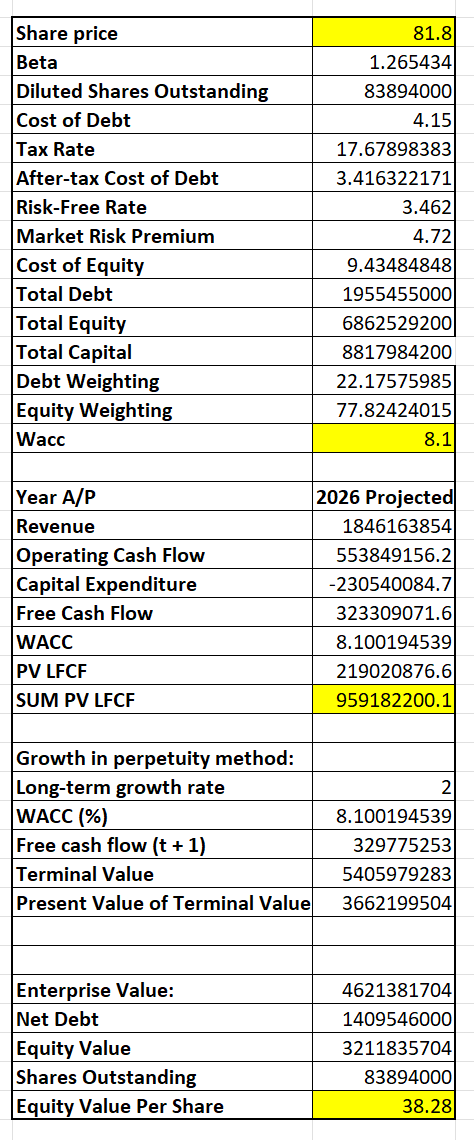

My leveraged DCF analysis doesn’t show anything better either. Forecasting revenue growth of 40% for 2022, 30% in 2023 and 20% through 2026 with OCF margins of 30% for each year through 2026 is an extremely optimistic way to look at things. Adding that number to our weighted average cost of capital at 8.1, we get the sum of the present value of leveraged free cash flow at almost 950 million. Using a long-term growth rate of 2%, we get net worth per share of $38. Note that even at very optimistic levels, we end up with an intrinsic value that is at least 50% below the current share price.

Leveraged DCF Analysis (Author’s calculations – Company data)

Stock

When I look at the many fitness channels that have gone public, I see hardly any that have provided meaningful returns for investors. In fact, this industry seems like a graveyard for investors. With a market capitalization of $7 billion, the downside risks to Planet fitness seem to far outweigh any upside gains and it seems the odds are stacked against this company (both internal and external factors can impede the success of the business). In light of this, I will take a small short position against the company.

Please note that there are significant risks involved in shorting a stock and if a position moves against you it could potentially wipe out your portfolio. To mitigate this, you may consider implementing a stop loss on your position and set it to a level where you are comfortable covering your loss. Another method that can be used is to buy an OTM option call. Depending on the liquidity of the option and how it is set up, even when your short position moves against you, your call option will indirectly counter that move. All of this will require active management, so the easiest route would be to take a position using OTM put options with a long expiration. I will also take a small position via put options designed to give me a significant advantage in the event of a large change/reset in its valuation. In a scenario where I have to exit my short position, my put options will still be in place and can therefore maintain my short position in the security.

news.google.com