[ad_1]

Better pricing, exposure growth, strong retention, favorable renewals, reinsurance deals and accelerated digitization in the fourth quarter likely benefited insurance industry players such as Chubb Limited BC, Unum Group A dish RenaissanceRe Holdings Ltd RNR, who must report tomorrow. However, an active level of disaster likely weighed on their performance.

Premiums likely benefited from continued price improvement, strong retention and exposure growth across all lines of business. An active catastrophic environment accelerated policy renewal rates and contributed to better pricing in the fourth quarter.

The fourth quarter of 2022 bore the brunt of winter storm Elliot. Karen Clark & Company estimates Elliot’s industry losses at around $5.4 billion. Nonetheless, improved pricing, reinsurance agreements, portfolio repositioning, reinsurance hedges, favorable reserve development and prudent underwriting should lead to improved underwriting results.

The increase in travel around the world has probably induced higher car premiums. A stronger mortgage market likely boosted mortgage insurance premiums. Low unemployment likely helped commercial insurance and group insurance.

Insurers, benefiting from an improving pricing environment, are likely to record better investment results. Last year saw seven rate hikes, with the fourth quarter seeing two hikes by the Fed. A larger investment asset base and alternative investments in private equity, hedge funds and real estate, among others, are expected to have contributed to net investment income.

Accelerated digitization is expected to have reduced costs, thereby improving margins. A strong capital position has helped insurers in strategic mergers and acquisitions to strengthen their competitive advantage, build on a niche, expand geographically and diversify their portfolio, in addition to increasing shareholder value through share buybacks and to increase dividends.

Let’s take a look at how prepared the aforementioned insurers are ahead of their Q4 2022 results on January 31.

According to the Zacks model, a company needs the right combination of two key ingredients – a positive earnings ESP and a Zacks rank of #3 (Hold) or better – to increase the chance of a profit surprise. You can discover the best stocks to buy or sell before they’re flagged with our earnings ESP filter.

ChubbFourth quarter premiums are expected to have benefited from strong premium retention, new business and renewal retention. Turnover likely benefited from improved premium income as well as higher investment income. Higher than expected cat losses probably weighed on underwriting profitability and therefore on the combined ratio. Expenses likely increased due to higher losses and loss-related expenses. Nevertheless, continued share buybacks should have provided an additional boost to net income. (Read more: Will Chubb pull off a surprise this earnings season?)

Zacks’ consensus estimate for Chubb’s fourth-quarter earnings per share of $4.22 indicates a 10.8% increase from the figure reported a year ago. The company has an earnings ESP of +2.72% and a #3 Zacks ranking.

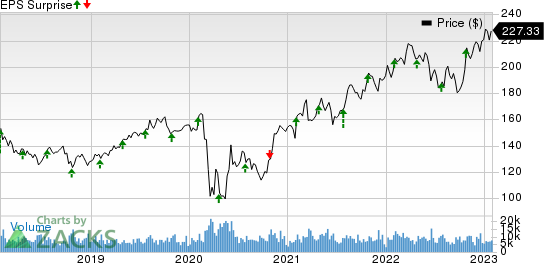

CB’s earnings have exceeded estimates in the last four reported quarters. This is represented in the table below:

Chubb limited price and EPS surprise

Chubb Limited price-eps-surprise | Limited quote from Chubb

Unum‘s Unum US segment should have benefited from favorable benefits experience across group product lines and higher premium income. Favorable benefits experience, higher premium income, growth in in-force blocks and higher sales are likely to have helped Colonial Life’s performance. In-force block growth and greater persistence likely benefited Unum International in the quarter ahead. Expenses have probably increased. Nevertheless, continued share buybacks should have provided an additional boost to net income. (Read more: Unum Group to report fourth quarter results: What’s coming?)

The Zacks consensus estimate for net income is pegged at $1.46, indicating a 64% increase from the figure reported a year ago. The consensus revenue estimate is pegged at $3 billion, indicating a 0.4% year-over-year increase. The company has an ESP on Earnings of -0.06% and a #2 Zacks Rank (Buy).

You can see the full list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Unum’s earnings have exceeded estimates in the past four reported quarters. The same is illustrated in the table below:

Unum Group Prize and EPS Surprise

Unum Group price-eps-surprise | Quote Unum Group

RenaissanceReFourth quarter results are expected to benefit from higher premiums in both its P&C and Specialties plus Property segments. Expenses have probably increased. Higher than expected cat losses probably weighed on underwriting profitability and therefore on the combined ratio. Nevertheless, continued share buybacks should have provided an additional boost to net income.

The Zacks consensus estimate for earnings is pegged at $6.58, indicating a 39.7% increase from the figure reported a year ago. The consensus revenue estimate is pegged at $1.8 billion, indicating a 27.3% year-over-year increase. The company has an ESP on Earnings of 0.00% and a Zacks Rank #2.

RNR’s earnings have exceeded estimates in two of the past four quarters while falling short in the other two. This is represented in the table below:

Award from RenaissanceRe Holdings Ltd. and BPA surprise

RenaissanceRe Holdings Ltd. price-eps-surprise | Quote from RenaissanceRe Holdings Ltd.

Stay on top of upcoming earnings announcements with Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today you can download 7 best stocks for the next 30 days. Click to get this free report

Chubb Limited (CB): Free Stock Analysis Report

RenaissanceRe Holdings Ltd. (RNR): Free Inventory Analysis Report

Unum Group (UNM): Free Stock Analysis Report

[ad_2]

news.google.com